Introduction: The "2015 Playbook" Problem

It starts bright and early Monday morning when you're reviewing your team's activity from last week. Your six sales reps made 247 cold calls to facilities across your territory, sent over 700 generic emails about "commercial cleaning services," and spent 20+ hours driving around office parks collecting business cards from front desk staff.

The result? Nine qualified conversations and three proposals submitted to prospects who "need to check with corporate" to get approval.

Meanwhile, two miles away, a new facilities director at a 150,000-square-foot medical office complex just started her role and is actively reviewing all vendor contracts, including replacing the current janitorial provider whose team missed several key areas during last month's service.

She needs quotes from qualified cleaning companies within 30 days, but your team has no idea this opportunity even exists.

This scenario plays out every day in commercial cleaning and janitorial markets across the country. Why? Sales teams are still using the same lead generation playbook from 2015: make more calls, send more emails, and hope something sticks.

This “spray-and-pray” approach worked before modern technology - but today, smartphones filter out calls from anyone not listed in Contacts. Email spam filters are filtering out repetitive messages. And many decision-makers have removed their contact information from LinkedIn profiles and other social platforms - making it increasingly difficult to reach them.

So while cleaning and janitorial companies still try to win by playing the numbers game with outdated tactics, competitors using property intelligence software are identifying facilities with management changes, building renovations, and immediate cleaning needs - often before decision-makers even begin their vendor search.

In this article, we'll walk you through how modern property intelligence transforms janitorial lead generation from reactive cold outreach to strategic opportunity identification. You'll see exactly why traditional methods leave money on the table and how intelligent targeting helps you reach facilities when they're most receptive to your services.

The Traditional Janitorial Lead Generation Playbook (And Why It's Failing)

Walk into many janitorial companies' sales meetings, and you'll hear familiar frustrations. Reps spend hours researching facilities online, making 100 cold calls per week to gatekeepers who can't make decisions, and competing against established relationships they never had a chance to influence.

The traditional approach treats every building as equally likely to need cleaning services, leading to conversations that sound like this:

"Hi, this is Mike from (Clean Services Company). I'm calling to see if you're happy with your current janitorial provider."

Or, “Hey Tammy, it's Mike from ProClean, we’re a janitorial company, and I’m wondering who makes vendor decisions for your building.”

The fundamental problem isn't the script—it's the timing and relevance. You're either talking to a gatekeeper or interrupting a busy facility manager who hasn't thought about their cleaning contract in months. In the worst cases, you’re asking them to consider changes to services they're satisfied with, at a moment when they're focused on completely different priorities.

Let’s look at how this strategy plays out with real data. According to Salesforce, 67% of sales reps don’t expect to meet their quota this year, and 84% missed it last year - and 53% of sales pros say it’s harder to sell than a year ago.

So the traditional playbook is killing sales team morale, increasing their workload to the point of impossibility - this not only hurts their paycheck, but it also means that you’re spending money on salespeople who don’t have the tools they need to perform at their best.

Cold Outreach: The Numbers Game That's Getting Harder

Consider this: sales reps spend approximately 72% of their time on non-selling activities, according to a Salesforce study of more than 7,700 reps across several countries.

This means that almost 75% of their salary is going to cover activities like:

Lead research

Lead prioritization

Manually entering prospect information

Prospecting

Administrative tasks

When representatives finally get to actual outreach, the results are equally frustrating. Cold calls convert at an average rate of 2.35% in 2025, or about one sale per 43 calls.

The math becomes even more challenging when you factor in gatekeepers, voicemail systems, and the increasing reluctance of facility managers to take unsolicited sales calls. What used to be a reliable prospecting and lead generation method now requires significantly more effort due to diminishing returns.

According to an EBQ study, typically, 1 out of every 10 prospects you're able to connect with will be qualified and ready for a sales conversation.

Frustrating.

The "Wait and Hope" Digital Strategy

Many janitorial companies have invested heavily in digital marketing strategies: SEO-optimized websites featuring commercial cleaning services, content marketing about facility maintenance best practices, and social media campaigns broadcasting their capabilities.

While these digital marketing efforts are important and can generate some leads by themselves, they're essentially passive approaches that depend on prospects having immediate needs and finding your content among dozens of competitors.

The challenge with "pull" marketing (organic digital marketing) in the janitorial industry is timing. A facilities director dealing with a service issue or management change isn't browsing cleaning company blogs - they're calling contacts in their network or reaching out to the first qualified provider who demonstrates knowledge and expertise of their specific situation.

Why Referral Programs Hit a Scaling Ceiling

Many janitorial companies also include referral programs for their network partners and other professionals in their local area, and referral partner programs remain a very valuable resource for janitorial companies, but they have inherent limitations that prevent them from driving consistent growth. Your best clients can only refer facilities within their immediate network of similar properties, and those referrals typically come months after prospects develop their need.

More importantly, you're competing against other cleaning companies for the same referral sources. When a property manager recommends vendors to a colleague, they're likely mentioning 2-3 companies, not just yours. So, you're still competing rather than identifying exclusive opportunities.

The Property Intelligence Revolution for Janitorial Services

This is where property intelligence solutions become game-changers for sales.

Property intelligence platforms transform janitorial prospecting by providing visibility into the specific events and changes happening at the property level that create immediate or near-term cleaning needs.

Instead of guessing which facilities might need services, you can identify proven triggers that indicate decision-makers are actively evaluating their cleaning partnerships.

How Does Property Intelligence Work?

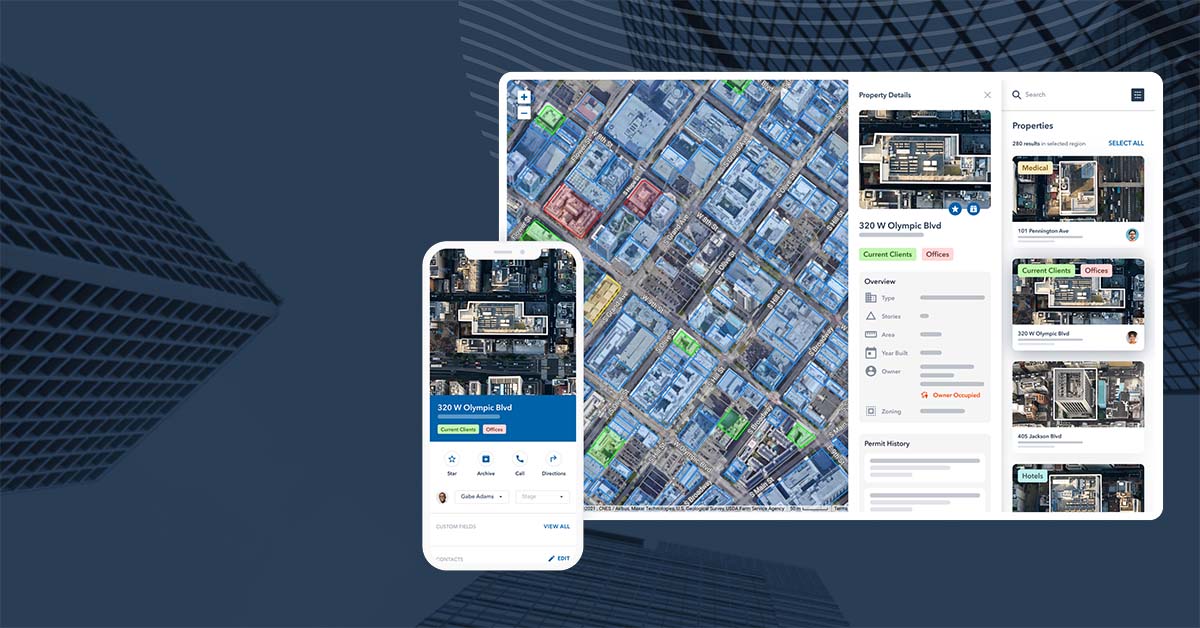

Think of property intelligence as having a research team monitoring every commercial building in your territory, alerting you when changes occur that suggest cleaning service opportunities. Here's how modern platforms like Convex operate:

Multi-Source Data Collection: Aggregates permits, ownership records, tenant changes, contact data, and geospatial imagery (satellite/aerial views) from public and private sources

Signals & Pattern Recognition: Proprietary buyer intent data identifies prospects ready to buy based on behavioral indicators and property activity

Map-Based Visualization: Displays properties geographically with filtering capabilities (building type, usage, size, age, ownership structure)

Generative AI for Outreach: Combines platform data (permits, signals, property info, decision-makers, equipment data) with your company data (services, team info, positioning) to create hyper-relevant personalized emails and phone scripts

This is wrapped in a simple interface that allows your sales team to go through a 4-step process to find warm leads, which takes 3-5 minutes per lead:

Log in to Convex and check the “Signals” category (our proprietary buyer intent data) to see who’s ready to buy in your market.

Then, search for any commercial property type, even multiple types, and access contact information, job titles, account names, property addresses, or tenants to identify who to contact, bringing up a list of prospects to pursue.

With just two clicks, you can use Generative AI trained on their buying signals and your own company and contact data to send them an email or draft a script for a phone call. (Pro Tip: If you want to go the extra mile, create a quick Loom video with the information you gather in Convex. Studies show this will not only give prospects the personalized touch they are looking for but also increase your conversion rates!).

Once you’ve sent the message, set up a follow-up or a reminder and add them to your pipeline in Salesforce, HubSpot, or another CRM of your choice - or skip the standalone CRM solutions and use Convex’s built-in CRM to keep everything in one place.

Instead of your reps spending 72% of their time (According to the Salesforce study mentioned in the previous section) on administrative tasks and research, property intelligence flips this equation on its head - enabling them to spend 70%+ of their time having actual sales conversations with prospects who have immediate cleaning needs.

How Property-Level Buying Signals Trigger Warm Sales Conversations

The power of property intelligence lies in identifying specific events that create urgency for facility decision-makers. These signals fall into several categories, each representing different levels of opportunity and timing.

Management Changes create the strongest buying signals for janitorial services. When a new facilities director, property manager, or building engineer joins an organization, they typically review vendor relationships relevant to their role within their first 90 days. New managers want to establish preferred partnerships, evaluate costs, and often make changes to demonstrate their impact on operations.

Traditional lead generation would never identify these transitions until months later, when contracts come up for renewal. But, property intelligence platforms track management changes as they happen, allowing you to reach new decision-makers during their active vendor evaluation period.

Building Renovation and Construction Permits indicate facilities preparing for changes that will significantly impact cleaning requirements. Office renovations create dust, debris, and a disrupted work area, requiring deep cleaning protocols. Medical facility upgrades often trigger updated sanitization standards. Manufacturing expansions may require specialized cleaning for new equipment areas.

The timing here matters significantly. Reaching out during the planning phase positions you as a strategic partner helping them prepare for changes, rather than just another vendor responding to an RFP after decisions are already made.

Property Ownership and Management Transitions frequently trigger comprehensive vendor reviews. When properties change hands or management companies acquire new buildings, they often evaluate all service contracts to align with their operational standards and preferred vendor networks.

But none of these are as powerful as a decision-maker actually looking for your services.

Buyer intent signals allow you to see what we call “signal strength,” or the level at which someone seems to be searching for a solution. This combines proprietary algorithms with data to show how likely someone at the property level is to make a purchase. As you can imagine, an email or phone call at the right time, to the right person, with the right message is far more likely to convert into a sale.

Industry-Specific Intelligence Opportunities

Different property types have distinct needs that create unique opportunities for janitorial companies with relevant expertise and positioning.

Medical Buildings and Healthcare Facilities face continuous pressure to maintain strict cleanliness standards. Joint Commission inspections, state health department reviews, and infection control audits create ongoing needs for specialized cleaning protocols. When these facilities expand, renovate, or change management, they need providers who understand healthcare cleaning requirements and can document their protocols for regulatory compliance.

Modern intelligence solutions can identify medical facilities with recent expansions, new management teams, or newly filed permits - all signals that indicate potential opportunities for healthcare cleaning specialists.

Commercial Property Managers represent some of the highest-value opportunities in janitorial lead generation. These decision-makers often oversee multiple buildings and can award contracts worth hundreds of thousands of dollars annually. They're practical buyers who understand facility management challenges and appreciate vendors who demonstrate knowledge of their specific properties.

Property intelligence reveals when management companies acquire new buildings, when tenant changes create additional cleaning needs, and when management team changes bring in new decision-makers. It also identifies ownership connections that can turn a single building contract into portfolio-wide opportunities.

Educational Facilities operate under unique seasonal patterns and regulatory requirements that create predictable but time-sensitive opportunities. Back-to-school deep cleaning requirements, summer facility improvement projects, and periodic health department inspections all create defined windows where educational facilities actively seek cleaning partners.

The Competitive Advantage: Timing + Relevance

The fundamental advantage of property intelligence isn't just better data—it's better timing combined with relevant messaging. Instead of interrupting prospects with generic sales pitches, you're reaching decision-makers when they're actively dealing with situations your services address.

Consider the difference between these two approaches:

Traditional Cold Call: "Hi, I'm calling about our janitorial services. Are you satisfied with your current cleaning company?"

Intelligence-Driven Outreach: "Hi, I noticed your medical facility received permits for office renovations. We specialize in helping medical buildings maintain their operations during construction while meeting cleanliness standards and managing disrupted work areas. Do you have 5 minutes to see if we’re a good fit?”

The second approach demonstrates knowledge of their specific situation and positions your services as a solution to their immediate challenge. Decision-makers respond to relevance, especially when they're under pressure to solve problems quickly.

Real Results: How Janitorial Companies Are Winning with Property Intelligence

Moreno & Associates: Streamlining 30 Years of Janitorial Expertise

Moreno & Associates, a Bay Area janitorial company with nearly 30 years in business and 220+ employees, provides building maintenance and cleaning services throughout California's Silicon Valley. When Kyleigh Moreno, Director of Sales, Marketing, and Development, became the sole person responsible for new business development, she needed technology to help scale their prospecting efforts.

After trying a major CRM platform that proved too complex and expensive, Kyleigh discovered Convex through LinkedIn outreach. The platform's hands-on demo and customer success support immediately differentiated it from other solutions she'd evaluated.

Key Results:

Team Adoption: "It's been amazing to get validation from the whole team on my decision to go with Convex. They understood that it's an important asset to helping us succeed in developing the business and bringing on new clients."

Process Modernization: Replaced time-consuming manual data entry from printed industry directories with comprehensive property and contact intelligence accessible through the Convex dashboard

Enhanced Customer Support: "I've never experienced this level of hands-on and dedicated customer service with any other team that I've worked with."

You can read the full version of this case study here.

Stratus Building Solutions: $125,000 in Annual Revenue in Four Months

Terri Reddan from Stratus Building Solutions' Pittsburgh franchise needed a solution that could help identify the right properties and effectively engage decision-makers. In the janitorial industry, finding the person "in charge of cleaning" can be the biggest challenge for sales teams.

"We decided to go with Convex because, of any products that I've seen on the market, I've never seen anything so enhanced," explains Terri. "I always refer to it as 'Google on steroids' because you can get so much information."

Quantifiable Results:

$125,000+ Annual Revenue: Generated directly attributable to the Convex platform in just four months

Reduced Cost Per Lead: Significant improvement compared to third-party lead providers

Operational Efficiency: Uses property intelligence to create localized target lists around existing customers, minimizing travel costs and maximizing face-to-face selling time

Data Accuracy: "The data accuracy has been on point. I clicked into a property for an existing customer and saw contact details for a person newly in charge of cleaning. His name was on there, and he had only been in that role for two weeks."

Strategic Territory Management: "I can put my franchise owners in there so I can know where they live relative to the different accounts. It's really important because when you look at this business, especially with gas prices getting so expensive nowadays, knowing that your current customers are in a certain area, you don't want people driving all around town."

You can read the full version of this case study on our website.

Strategic Implementation: Building Your Modern Lead Generation System

Defining Your High-Value Target Profile

Modern janitorial lead generation succeeds by focusing efforts on prospects with the highest revenue potential and strongest indicators of immediate need. Property intelligence allows you to identify and prioritize these opportunities systematically.

Revenue Potential Analysis starts with understanding which property types generate the highest contract values in your market. Medical facilities and laboratories typically require specialized cleaning protocols that command premium pricing. Large office complexes provide economies of scale with substantial square footage. Educational institutions often offer multi-year contracts with stable, predictable revenue.

Property intelligence reveals the specific attributes that indicate high-value opportunities: building square footage, tenant density, regulatory requirements, and ownership structure. A 200,000-square-foot medical office building with multiple tenants represents significantly more opportunity than a 10,000-square-foot single-tenant office space.

Contract Longevity Indicators help identify prospects likely to become long-term partnerships. Properties with stable ownership, established facility management teams, and ongoing maintenance needs typically maintain cleaning relationships for years rather than months.

Property Intelligence-Driven Outreach Sequences

Success with property intelligence requires crafting outreach that addresses specific property situations rather than generic cleaning service capabilities. The intelligence provides context needed for relevant, compelling opening conversations.

Management Transition Messaging targets new decision-makers during their vendor evaluation period:

"Congratulations on your facilities director role at [Property Name]. Many new facility managers prefer to evaluate their vendor relationships early in their tenure. We've helped similar medical buildings reduce costs while improving service quality, and I'd like to discuss how we might support your objectives."

Renovation and Construction Outreach addresses facilities preparing for changes that impact cleaning requirements:

"I noticed your facility recently pulled permits for office renovations. We specialize in helping office buildings maintain their operations during construction projects, including managing dust control and coordinating around contractor schedules."

Property Portfolio Opportunities leverage ownership connections for expanded relationships:

"I see your management company recently acquired the office complex on Main Street. We currently provide janitorial services for two other properties in your portfolio, and I'd like to discuss how we could support your new acquisition with consistent service standards."

Technology Integration and Team Training

Successful implementation requires integrating property intelligence with existing sales processes while training teams to interpret signals and craft relevant messaging.

CRM Integration ensures that intelligence-driven leads flow seamlessly into your sales pipeline. Look for a commercial services-focused property intelligence platform that offers bidirectional integration with popular CRM systems, allowing you to push qualified prospects while maintaining activity tracking and pipeline management.

Signal Interpretation Training helps representatives understand the meaning of different property events for cleaning service opportunities. A medical facility expansion indicates increased square footage and potentially enhanced sanitization requirements. Office building ownership changes suggest vendor relationship reviews. Construction permits signal temporary but intensive cleaning needs.

Territory Optimization uses geographic clustering to maximize face-to-face selling time while minimizing travel costs.

Property intelligence platforms like Convex allow you to outline your territory on a map (like Google Maps or MapQuest) to reveal all the commercial properties in that area. This allows you to see where multiple high-value prospects exist within efficient driving distances - exactly the approach Stratus Building Solutions uses to manage gas costs and improve productivity.

The Future of Janitorial Lead Generation

Market Evolution and Competitive Positioning

The janitorial services market is experiencing a fundamental shift in how facility managers evaluate and select cleaning providers. Decision-makers increasingly expect vendors to understand their specific challenges and demonstrate relevant expertise rather than just competitive pricing.

Early Adopter Advantages are becoming apparent as companies using property intelligence win contracts they previously wouldn't have known existed. According to industry data, teams using property and sales intelligence systems like Convex experience a median 9x ROI within 12 months of implementation.

Decision-Maker Expectations have evolved beyond simple service comparisons. Modern facility managers want partners who understand their regulatory requirements, operational challenges, and property-specific needs. Generic sales approaches increasingly get filtered out or ignored entirely.

The Technology Adoption Curve creates a window of competitive advantage for janitorial companies that embrace property intelligence before it becomes industry standard. Companies making this transition now will be positioned as market leaders when intelligence-driven prospecting becomes the expected approach.

Implementation Roadmap for Sales Managers

Making the transition from traditional to intelligence-driven lead generation isn’t hard, but it does require a structured approach if you want to minimize disruption while maximizing results.

Phase 1: Current State Assessment involves calculating the true cost of traditional prospecting methods, including representative time, technology costs, and opportunity costs of missed prospects. This baseline helps justify property intelligence investment and provides comparison metrics for measuring improvement.

Phase 2: Platform Evaluation requires understanding which solutions offer the property types, geographic coverage, and integration capabilities that match your market focus. Look for platforms built specifically for commercial services rather than generic sales intelligence tools.

Phase 3: Team Training and Process Integration focuses on helping representatives understand signal interpretation, relevant messaging, and intelligence-driven pipeline management. This phase typically requires 4-6 weeks for full adoption.

Phase 4: Performance Optimization involves analyzing which signals produce the best results, which messaging approaches generate the highest conversion rates, and how to expand successful approaches across larger territories.

Conclusion: Choose Your Lead Generation Future

The janitorial services market stands at a critical juncture. Traditional lead generation methods - cold calling every facility, generic digital marketing, and waiting for referrals - are increasingly ineffective against competitors using property intelligence to identify prospects with immediate needs and perfect timing.

While your team makes hundreds of cold calls hoping to find facilities ready for new cleaning services, companies like Moreno & Associates and Stratus Building Solutions are systematically identifying buildings with management changes, construction projects, and property transitions that create immediate opportunities for qualified cleaning providers.

The choice isn't just about adopting new technology - it's about positioning your company as a knowledgeable partner who understands facility challenges and can provide solutions exactly when they're needed. Property intelligence enables this transformation by providing the timing and context that turn interruption-based selling into value-based consultation.

Companies that understand this shift and implement property intelligence now will capture market share while competitors continue making cold calls to prospects who aren't ready to buy. The window for early-adopter advantages is closing, but the opportunity for transformation remains significant.

Ready to transform your approach from reactive cold calling to proactive opportunity identification? Schedule a demo to see how property intelligence can help you identify facilities with immediate cleaning needs and reach them before competitors even know the opportunities exist.

Share