Introduction

You've just spent three hours presenting a solar proposal to what seemed like a perfect prospect: a 100,000 square foot warehouse with southern exposure and high energy bills. The facility manager nodded enthusiastically, asked great questions, and promised to "run the numbers with the team."

Six months later, you're still waiting for that callback.

Sound familiar? If you're in commercial solar sales, you know this frustration intimately. You're spending most of your time chasing prospects who will never actually install solar—no matter how compelling your proposal or how many times you follow up.

The problem isn't your sales skills or product knowledge. It's that you're prospecting blind, targeting buildings based on size and roof space without understanding the factors that actually predict solar adoption.

The solar companies that consistently win have figured out something important: they use property intelligence to identify buildings showing genuine buyer intent—recent energy audits, sustainability certifications, ownership changes, and other signals that indicate real purchase readiness.

This article shows you how to leverage building characteristics and buyer intent data to focus on warm commercial solar leads that actually convert, while avoiding the time-wasters that drain your pipeline.

Why Most Commercial Solar Leads Never Convert

Here's what I've learned from talking to solar sales teams across different markets: most reps focus on technical feasibility while completely ignoring business readiness for solar.

Traditional solar prospecting looks for buildings with these characteristics:

Large, unobstructed roof space

Southern exposure with minimal shading

High electricity consumption

Stable business operations

These factors matter for installation viability, but they don't predict purchase likelihood. A building might be perfect for solar from an engineering perspective while being completely wrong from a sales perspective.

The Hidden Barriers to Solar Adoption

The solar industry has some specific barriers that must be overcome in nearly every sales process:

Financial Decision-Making Authority: Many facility managers express interest in solar but lack budget authority. Without understanding the decision-making structure, you're presenting to influencers rather than buyers. Solar installations typically require board approval or C-level sign-off due to the capital investment size.

Capital Investment Priorities: Even profitable companies have competing priorities. A business planning major facility upgrades might delay solar installation for years, regardless of ROI calculations. Solar competes with equipment replacements, facility expansions, and technology upgrades for the same capital budget.

Lease and Ownership Constraints: Many seemingly ideal buildings face lease restrictions that prevent solar installation. Tenant-occupied buildings often require landlord approval, complex lease modifications, or revenue-sharing agreements that complicate the sales process.

Utility Interconnection Complexity: Some properties face utility cooperation challenges, grid capacity limitations, or complex interconnection requirements that can delay or prevent solar installation. These issues often surface late in the sales process after significant time investment.

Energy Contract Obligations: Businesses locked into long-term energy contracts may show interest in solar but lack the flexibility to make immediate changes. Understanding contract expiration dates becomes critical for timing outreach.

The most savvy solar sales teams have shifted from engineering-focused prospecting to business-readiness analysis. They identify prospects showing actual intent to purchase rather than theoretical ability to integrate a solar energy strategy.

Building Characteristics That Signal Solar Readiness

While roof space and sun exposure matter for system design, other building characteristics better predict purchase likelihood. Property intelligence reveals these hidden indicators that separate serious prospects from window shoppers.

Ownership Structure and Decision-Making

While many property owners and managers may be interested in solar, these are prime indicators of actual ability to integrate these energy solutions:

Owner-occupied buildings have significantly higher solar adoption rates than tenant-occupied properties. Property owners can capture long-term energy savings and tax benefits, while tenants face lease restrictions and limited payback periods.

Recent ownership changes often indicate capital improvement planning. New owners frequently evaluate all building systems, creating opportunities for energy upgrades, including solar installation. Property intelligence can identify these ownership transitions automatically.

Single-entity ownership versus complex ownership structures affects decision-making speed. Buildings owned by partnerships, REITs, or management companies often have slower approval processes than single-owner properties.

Why? Increased energy costs, simpler decision-making processes - these all lead to shorter sales cycles and bigger impact.

Building Age and Infrastructure Readiness

But just because an owner may be interested in solar doesn’t mean the building can handle the new infrastructure. Some indicators of building readiness are:

Modern electrical infrastructure is crucial for solar integration. Buildings constructed or renovated within the past 10-15 years typically have electrical panels and wiring capable of supporting solar without major upgrades. Older buildings may require costly electrical improvements that reduce solar ROI.

Recent roof work creates ideal solar opportunities. Properties with new roofing installations eliminate concerns about structural integrity and provide 20+ year platforms for solar systems. Property intelligence can track roofing permits to identify these prime prospects.

Energy-efficient building systems indicate sophistication and cost-consciousness that correlate with solar interest. Look for properties with recent HVAC upgrades, LED lighting installations, smart building controls, and energy management systems.

Industry and Operational Patterns

Certain business types show higher solar adoption rates based on energy usage patterns and financial characteristics:

Manufacturing and Distribution: High daytime energy consumption aligns with solar generation, stable operations supporting long-term investments, and cost-conscious management teams focused on operational efficiency.

Healthcare and Senior Living: Predictable energy usage patterns, regulatory requirements for backup power, and corporate sustainability initiatives driven by community reputation.

Education and Municipal: Sustainability mandates, stable long-term ownership, and budgeting processes that accommodate capital improvements with long-term payback periods.

Retail and Hospitality: Large roof areas, daytime operational patterns matching solar generation, and management teams focused on operational cost reduction.

Understanding these characteristics helps solar sales teams prioritize prospects with genuine purchase potential rather than chasing every large building in their territory.

According to National Renewable Energy Laboratory analysis, there are over 8 billion square meters of rooftops suitable for solar installation in the United States, representing over 1 terawatt of potential capacity—but technical potential doesn't equal sales potential.

Buyer Intent Signals That Separate Serious Prospects from Window Shoppers

The difference between prospects who buy and those who just like to browse is a combination of timing and intent. “Timing” can be driven by increasing energy costs, efficiency incentives, and regulatory change, but it can also be owner or manager-driven - this is where buyer intent signals can drive the sales pipeline.

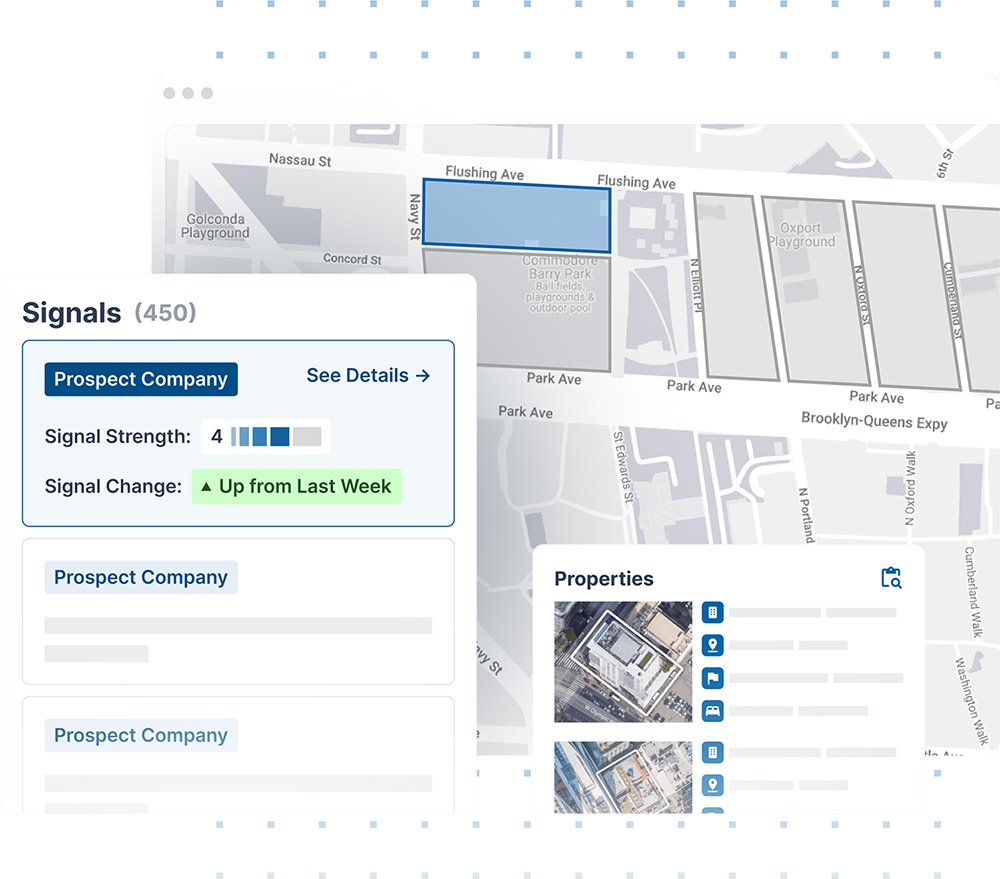

Property intelligence solutions like Convex reveal specific signals indicating active interest in energy improvements and solar adoption.

Energy Management and Efficiency Activity

While most property intelligence solutions don’t directly track recent energy audit activity (as this is often private data), there are a few indicators that can give you an idea of the building’s readiness for solar.

Property intelligence systems like Convex can identify buildings that have:

Filed permits for energy assessment work or installed new energy monitoring systems

Decision-maker searches for energy consulting firms or utility energy audit programs

Recent energy audit activity shows genuine interest in cost reduction and efficiency improvements. On average, commercial buildings waste 30% of their energy, according to the EPA, making energy assessments a logical first step for cost-conscious property managers. Buildings completing energy assessments are significantly more likely to implement renewable energy projects within 12-18 months.

Sustainability and Environmental Initiatives

Environmental certification pursuits demonstrate commitment to sustainability beyond casual interest. These initiatives create internal momentum for renewable energy adoption.

Strong intent signals include:

LEED certification applications or renewals

ENERGY STAR building registrations

Corporate sustainability report publications

Environmental goal announcements on company websites

Once again, these are not generally tracked by data-driven platforms - but buyer intent data can reveal a completely different story when you dig a bit deeper. These insights can also be found by searching company websites for initiatives that are relevant triggers for sales outreach.

Financial and Operational Changes

Another driver is business change. Several business changes create opportunities for solar adoption by affecting energy priorities, available capital, or decision-making authority:

Facility expansion or renovation projects often include energy system upgrades, creating natural opportunities for solar integration during construction phases.

New property management contracts can bring fresh perspectives on energy cost management and sustainability initiatives.

Corporate acquisitions or ownership changes often trigger facility assessments and capital improvement planning that includes energy system evaluation.

These can be core efficiency drivers in a business. When an acquisition happens, many businesses need to consolidate costs to accommodate new debt service requirements, and solar can be a great way to minimize ongoing costs.

Regulatory and Compliance Drivers

Finally (and we alluded to this a bit earlier in the article), regulatory changes are a primary driver of efficient energy solutions.

Environmental compliance requirements may view solar as a strategic response addressing multiple objectives simultaneously.

Monitor for:

Environmental, regulatory, and compliance changes in your local market

Carbon footprint reporting requirements

Municipal sustainability mandate responses

Industry-specific green building requirements

These can be tracked on the customer side in signals or you can use local governmental requirements as a trigger for outreach to educate and inform decision-makers before they face possible fines.

Property Intelligence Beyond Roof Size and Sun Exposure

Most solar sales teams still prospect like it’s 1995, using basic criteria like building size and roof visibility. Property intelligence reveals the business factors that actually predict solar adoption, giving you a competitive advantage over reps still driving around looking at rooftops.

Data Integration for Solar Sales

Once you have access to building specifications, ownership structures, and permit activity, you can create a qualification system that prioritizes prospects based on solar readiness rather than just roof size.

Here's how successful solar teams structure their workflow:

Step 1: Data-Driven Filtering Start with buildings showing multiple readiness indicators—recent electrical permits + owner-occupied + energy efficiency investments.

Step 2: Intent Signal Prioritization Layer in buyer intent data to identify which qualified buildings have decision-makers actively researching energy solutions.

Step 3: Timing-Based Outreach Contact prospects when their building data aligns with optimal timing factors—budget cycles, contract renewals, or facility improvements.

This systematic approach transforms property intelligence from information overload into actionable sales priorities.

Workflow Integration for Solar Teams

Territory Analysis: Upload your service area and identify all commercial properties meeting solar prospect criteria—not just buildings visible from the street.

Smart Filtering: Sort by recent permit activity, ownership changes, building improvements, or sustainability certifications rather than just building size and roof space.

Prospect Research: Access detailed building profiles including ownership details, recent improvements, and business factors that predict solar adoption likelihood.

Targeted Outreach: Contact decision-makers with building-specific talking points based on actual business changes and improvement activities.

Competitive Intelligence: Understand solar adoption patterns in your territory and identify underserved market segments with high potential.

This is where Convex's platform specifically helps commercial solar sales teams find properties the way they sell.

Log in to Convex and check the “Signals” category (our proprietary buyer intent data) to see who’s ready to buy in your market.

Then, search for any commercial property type, even multiple types, and access contact information, job titles, account names, property addresses, or tenants to identify who to contact, bringing up a list of prospects to pursue.

With just two clicks, you can use Generative AI trained on their buying signals and your own company and contact data to send them an email or draft a script for a phone call. (Pro Tip: If you want to go the extra mile, create a quick Loom video with the information you gather in Convex. Studies show this will not only give prospects the personalized touch they are looking for but also increase your conversion rates!).

Once you’ve sent the message, set up a follow-up (or) reminder and add them to your pipeline in Salesforce, Hubspot, or another CRM of your choice.

The system combines property intelligence with buyer intent signals, enabling you to prioritize properties where decision-makers are actively researching energy solutions. Instead of cold-calling every building with a large roof, you focus on prospects showing actual interest in energy improvements and solar solutions.

The Real Solar Decision-Making Process

Here's something I learned the hard way: the biggest difference between deals that close and those that drag on for months isn't your technology or pricing—it's understanding who actually makes decisions and when they're ready to make them.

I once spent three months nurturing what seemed like a perfect prospect. Great building, enthusiastic facility manager, compelling ROI. But when it came time to sign, I discovered the facility manager needed board approval for anything over $50K. The board met quarterly. Guess when their next meeting was?

Who Can Actually Say "Yes"?

The fastest deals I've seen happen with owner-occupied buildings where the business owner controls both operations and capital decisions. No committees, no corporate approval chains—just one person who can look at the numbers and decide. These deals can close in weeks instead of months.

But here's where it gets tricky with larger organizations. That enthusiastic facility manager might love your proposal, but if they can't write checks over $25K, you're not talking to the buyer—you're talking to an influencer. The key is mapping the approval chain early. Who influences the decision? Who signs the check? How long does their process typically take?

I've learned to ask directly: "What's your approval process for capital projects like this?" Most facility managers will tell you exactly what you're dealing with if you just ask.

Do They Have the Money?

Authority without resources is just a polite conversation. Here's what I look for: recent facility improvements. If a building upgraded their HVAC system last year or put on a new roof, that tells me two things—they have capital available and they're willing to invest in building improvements.

Cash flow stability matters too. Solar installations require businesses that can support long-term commitments, whether through cash purchase or financing. A company that's been laying off staff or struggling with operational issues isn't ready for a 20-year solar investment, regardless of how good the numbers look.

Can They Actually Execute?

Even with authority and budget, some organizations just can't get out of their own way. The best prospects have professional facility management teams who've managed complex projects before. They understand permitting, contractor coordination, and system integration.

Early adopters are gold. If they've already invested in building automation or smart systems, they're comfortable with technology and long-term thinking. They view solar as part of a comprehensive building strategy, not just a one-off energy project.

When Are They Ready to Act?

Perfect prospects still won't buy at the wrong time. Rising utility bills create urgency—especially those peak demand charges that hit industrial facilities hard. When a prospect mentions their electric bill just went up 15%, that's your opening.

Regulatory pressure works too. Companies facing sustainability reporting requirements or carbon reduction mandates have business reasons beyond cost savings. They need solar to hit compliance targets, which creates urgency traditional ROI arguments can't match.

But timing isn't just about external pressure. Smart solar reps track budget cycles. If you're pitching in July to a company that plans capital projects in December, you're either getting pushed to next year's budget or competing against projects they've already planned.

Do They Think Like Investors?

There's one more thing you have to watch for, and it usually becomes obvious in the first five minutes of conversation. The best prospects think like investors, not spenders.

You could have two nearly identical buildings. Same size, same energy usage, same ROI projections. The first guy might ask, "What's my payback period, and how does this affect my taxes?" The second will ask, "What's this going to cost me upfront?"

Guess which one closed?

The “investor-minded” prospect understands payback periods, tax implications, and lifecycle costs. They see solar as a strategic financial decision with long-term benefits.

The cost-focused prospect? He spent two months nickel-and-diming every component, questioning every line item, and asking for three more quotes. Even after all that analysis, he may not pull the trigger because he’s stuck thinking about the upfront investment instead of the 20-year savings.

You can spot this difference immediately. Investor-minded prospects ask, "What will this save me?" Cost-focused prospects ask, "What will this cost me?" Same information, completely different mindset.

When Everything Clicks

Here's what I've discovered after years of chasing the wrong prospects: when you find that sweet spot—decision-making authority, available capital, operational sophistication, optimal timing, AND investor thinking—something magical happens.

Instead of six-month sales cycles with endless follow-ups and committee meetings, you're having productive conversations with people who are genuinely ready to buy. No more chasing facility managers who "need to run it by the boss." No more explaining why solar makes sense to prospects who are already convinced.

For this reason, most successful solar reps have completely changed how they prospect. They're not making more calls—they're making better calls. They've stopped chasing every building with a big roof and started focusing exclusively on prospects who meet a “readiness criteria.”

This drastically changes their results. Most reps say their conversion rates have doubled while their sales cycles got cut in half when they took a more efficient approach to the sales cycle. That's not about getting lucky with better leads. That's about systematically identifying people who are actually positioned to buy.

Timing Your Solar Outreach for Maximum Impact

Even perfect prospects won't buy solar at the wrong time. Property intelligence reveals timing factors that indicate optimal outreach moments—when businesses are most receptive to solar proposals and capable of making purchase decisions.

Capital Planning and Budget Cycles

Most commercial properties follow predictable budget planning cycles that create natural opportunities for solar sales:

Q4 Capital Planning: The Q4 budgeting process ensures resources are allocated effectively for the upcoming year, when businesses finalize next year's capital improvement budgets and evaluate major investments.

Fiscal Year Transitions: Often bring new priorities, available capital, and strategic planning activities that include facility improvements.

Tax Planning Periods: When businesses actively seek investment opportunities that provide tax benefits, solar's investment tax credits are more attractive.

Solar proposals presented during active budget planning have a higher approval likelihood than mid-year requests because they align with natural decision-making cycles.

Facility Improvement Windows - Great Triggers for Outreach

Construction and Renovation Projects: Solar installation during facility improvements reduces costs and complexity. Monitor permit activity to identify these integration opportunities.

Equipment Replacement Schedules: HVAC, electrical, or roofing system replacements create opportunities for coordinated upgrades that minimize disruption and installation costs.

Lease Renewal Negotiations: When property improvements are often negotiated, solar installations can be structured as lease improvements or tenant incentives.

Energy Contract and Rate Changes

Contract Expiration Timing: Businesses evaluating new energy contracts are most receptive to solar proposals because they're already analyzing energy costs and options.

Rate Increase Notifications: Utility rate hikes create urgency for cost reduction solutions, making solar's value proposition more immediate and compelling.

Peak Demand Assessments: When businesses analyze energy usage patterns, solar generation can address peak demand charges and total energy cost optimization.

Seasonal and Market Factors

High Energy Cost Periods: Summer cooling seasons and winter heating periods highlight energy expenses, making solar savings more apparent and compelling.

Quiet Operational Seasons: When facility managers have time for strategic planning and vendor meetings, they avoid busy operational periods when immediate concerns take priority.

Industry Conference Cycles: Post-conference periods often show increased interest in sustainability initiatives and renewable energy solutions following industry education and networking events.

Tools like Convex can track these timing factors across your territory, enabling strategic outreach when prospects are most likely to engage and make purchase decisions.

Building Your Qualified Solar Prospect System

Creating a sustainable solar lead generation system requires systematic processes that consistently identify ready buyers while filtering out window shoppers. The most successful solar sales teams follow structured approaches that leverage property intelligence for predictable results.

Foundation: Property Intelligence Integration

Comprehensive Building Data: Access to real-time or regularly updated building information, ownership details, and business characteristics across your territory. Look for platforms providing permit tracking, building infrastructure data, and other facility improvement factors.

Intent Signal Monitoring: Systems that track when prospects research energy solutions, sustainability certifications, or solar installation information, indicating active interest rather than passive curiosity.

Territory Management Tools: Geographic analysis capabilities that identify prospect clusters, optimize routing, and track market penetration by building type and location.

Prospect Qualification Framework

Primary Qualification Criteria:

Ownership structure supporting decision-making authority

Building infrastructure compatible with solar installation

Financial stability indicates investment capacity

Energy usage patterns match solar generation benefits

Secondary Indicators:

Recent facility improvements show capital investment patterns

Sustainability initiatives demonstrating environmental commitment

Regulatory drivers are creating urgency for renewable energy adoption

Energy cost pressures are motivating cost reduction solutions

Disqualification Factors:

Complex lease restrictions prevent solar installation

Recent solar installations or long-term energy contracts

Financial instability or operational uncertainty

Building infrastructure requiring major electrical upgrades

Systematic Outreach and Follow-up

Priority-Based Contact Strategy: Immediate outreach for prospects meeting multiple qualification criteria with active intent signals. Regular follow-up for qualified prospects without immediate buying signals. Long-term monitoring for prospects with good fundamentals but poor timing.

Building-Specific Messaging: Reference recent facility improvements, sustainability initiatives, or energy challenges specific to each prospect. Demonstrate understanding of their business situation and facility characteristics.

Value Proposition Alignment: Emphasize cost savings for financially motivated prospects, sustainability benefits for environmentally focused organizations, and operational advantages for efficiency-conscious facility managers.

Performance Tracking and Optimization

Key Metrics for Solar Sales Success:

Prospect-to-customer conversion rates by qualification criteria

Sales cycle length for different prospect types and timing factors

Revenue per prospect for qualified versus unqualified leads

Territory performance and resource allocation effectiveness

Continuous Improvement Process: Monthly analysis of which building characteristics and intent signals produce the best conversion rates. Territory performance comparison and resource reallocation based on results. Sales process refinement based on successful deal patterns and common objection themes.

This systematic approach typically produces significant improvement in conversion rates while reducing time investment in unqualified prospects.

Conclusion

Stop wasting time on window shoppers who will never buy solar, regardless of how compelling your proposal or persistent your follow-up. The difference between successful and struggling solar sales teams isn't product knowledge or presentation skills—it's prospect selection.

Property intelligence transforms solar prospecting from guesswork into systematic identification of ready buyers. Instead of hoping to catch prospects at the right moment, you can identify buildings showing genuine buying signals and optimal timing factors.

The key advantages we've covered:

Business Readiness Analysis: Focus on buildings with decision-making authority, financial capacity, and operational sophistication to evaluate solar installations.

Intent Signal Recognition: Identify prospects actively researching energy solutions rather than those expressing casual interest in solar technology.

Timing Intelligence: Contact prospects when they're planning capital improvements, evaluating energy contracts, or facing cost pressures that make solar compelling.

Systematic Qualification: Use consistent criteria to prioritize prospects with the highest conversion potential while avoiding time-wasters.

The commercial solar market continues to grow as businesses increasingly prioritize sustainability and energy cost management.

The commercial solar segment grew by 4% compared to Q1 2024, adding 486 MWdc of installed capacity. This growth won't automatically translate to revenue for your organization without systematic identification of prospects with genuine purchase intent.

Ready buyers aren't just buildings with good sun exposure—they're organizations positioned to make solar investments. Understanding building characteristics, intent signals, and timing factors enables you to focus on prospects who are actually likely to convert.

The most successful solar sales teams have shifted their approach from technical feasibility prospecting to business readiness analysis. They identify fewer prospects but close dramatically more deals because they're targeting genuine buyers instead of casual browsers.

Ready to stop chasing window shoppers and start closing ready buyers?

Schedule a demo of Convex today to discover how property intelligence can help you identify commercial solar prospects with genuine purchase intent and optimal timing factors in your territory.

Share